Cryptocurrency has been making headlines recently as it becomes more widely known and accepted by online businesses around the world. It’s easy to see why there’s so much hype surrounding this new technology it holds the potential to fundamentally change how we use money in our daily lives. But what is cryptocurrency, and how does it work? And which cryptocurrencies should you know about, and how can you start using them?

Why Learn About Digital Currencies?

With digital currencies on the rise, it’s more important than ever to understand how they work and what implications they have for the future of finance. Cryptocurrencies are still a relatively new phenomenon, and as such, there is a lot of misinformation out there. Learning about digital currencies can help you make informed decisions about whether or not to invest in them. More importantly, it can give you insight into the risks that might be associated with these assets. The point of this course is to provide an overview of cryptocurrencies so that you know where to start your research if you’re interested in buying some coins yourself. It will cover everything from Bitcoin to Ethereum and everything in between, but will primarily focus on Bitcoin. If you’ve been hearing about Bitcoin lately but don’t really know anything about it then this is the course for you! We’ll take a deep dive into all aspects of Bitcoin from getting started (downloading wallets) to investing strategies (Bitcoin futures trading). I’m excited to teach you everything I’ve learned since I got involved with cryptocurrency! Together we’ll explore its history, how it works, which platforms exist to trade crypto-assets, and much more. And once you’re confident in your knowledge of digital currencies, we’ll talk about when and why you should buy bitcoin instead of traditional investments like stocks or bonds.

Key Terms and Definitions

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. The Blockchain is an open ledger of all transactions ever made using bitcoins from its inception to date. Mining Bitcoins takes significant computing power and is usually done by large companies with specialized hardware. Anyone can invest in cryptocurrencies as long as you have access to an exchange which trades them such as Bitstamp or Coinbase, both of which require KYC (Know Your Customer) verification. As currencies, cryptocurrencies are highly volatile and should only be invested in if you can afford to lose your investment. In general, there’s always a chance of getting hacked while trading or investing in cryptocurrencies so it’s important to use strong passwords, 2FA codes and never trade more than you’re willing to lose at any given time. Additionally it’s important to understand what happens when your coins get lost.

What are Bitcoin, Ethereum, and Ripple?

Bitcoin, Ethereum, and Ripple are all digital currencies that use blockchain technology. Bitcoin is the most well-known cryptocurrency, but Ethereum and Ripple are also gaining popularity. Cryptocurrencies are often used as an investment, but they can also be used to purchase goods and services. In order to buy any cryptocurrencies, you first need a wallet. You can get a wallet by downloading one from a site like Coinbase or Coindesk. Once you have your wallet setup, you will need to purchase either Bitcoin or Ether with traditional currency on sites like GDAX or Gemini. Finally, you will trade your BTC or ETH for other cryptocurrencies like Ripple on sites like Binance . It’s important to note that in some cases, there may be limits placed on how much cryptocurrency you can buy or sell during a given period of time. Some countries have even banned trading in cryptocurrencies entirely. There are many risks associated with trading in cryptocurrencies because it’s still so new. That being said, if done correctly, investing in digital currencies could yield some high returns due to the increasing demand and limited supply. The decentralized nature of these currencies means that no government can create more when needed, unlike fiat currencies which governments just print more of whenever they want.

A fully informative blog post about cryptocurrencies should not just describe what different types exist, but explain how each type works and why it might be worth purchasing.

If you’re interested in learning more about cryptocurrency (or alt coins), check out our ultimate course here!

— — -FULL COURSE LINK — — -

How Do You Buy Bitcoins?

There are a few different ways to buy bitcoins. The most common way is through a bitcoin exchange. These websites connect buyers and sellers and allow them to trade bitcoins for other currencies or for other assets, such as gold. Another way to buy bitcoins is through a bitcoin ATM. These machines allow you to insert cash and receive bitcoins in return. Finally, you can also earn bitcoins by mining them. This is how new bitcoins are created. Bitcoin miners use special software to solve math problems and are issued a certain number of bitcoins in return. Some people argue that it’s not worth it to mine bitcoins because their values have been steadily decreasing. Bitcoin prices today range from about $4000–5000 per coin. However, many experts say that the value will continue to grow over time because more people want to use these coins instead of dollars and euros. Countries like Venezuela and Zimbabwe even switched to using bitcoins so they could avoid hyperinflation of their national currency. Whether you’re looking to invest or just learn more about cryptocurrency, this blog post has covered all the basics! If you’re interested in investing, try to read up on some different types of cryptocurrencies, such as Ripple and Ethereum. If you would rather spend your money than keep it under your mattress, research what digital wallets are available before choosing one. Finally, if you find yourself constantly checking the price changes on your phone (it’s okay!), make sure that mobile app notifications are turned off or only include price updates once an hour at most. You don’t want to be distracted during work every time there’s a little fluctuation in the market. A good rule of thumb is that whenever you feel tempted to check the price again, take five deep breaths and then walk away from your screen. It sounds counterintuitive, but the less attention you give to digital markets, the less stressed out you’ll become. With enough practice, walking away becomes second nature and soon enough you’ll stop thinking about crypto entirely!

4 Tips on How To Use Bitcoin

Bitcoin can be used to buy things electronically. In that sense, it’s like conventional dollars, euros, or yen, which are also traded digitally. However, bitcoin’s most important characteristic is that it is decentralized. No single institution controls the bitcoin network. This puts some people at ease, because it means that a large bank can’t control their money. The flip side is that if your computer crashes, you lose everything. Bitcoins aren’t insured by the FDIC (Federal Deposit Insurance Corporation). People need to learn how bitcoin works and understand its risks before they invest in it. One popular method for investing in bitcoins is through a Bitcoin IRA, which may be attractive to investors who don’t want all of their eggs in one basket.

The main way that bitcoins are bought and sold is through online exchanges such as Coinbase or LocalBitcoins. When someone wants to sell bitcoins, he or she uploads them to the exchange and provides an asking price. When someone wants to buy bitcoins, he or she enters the amount of bitcoins being requested and states the price he or she would pay. If both parties agree on a trade, then it occurs instantly with no middleman needed. There is no central authority that regulates these trades so there are relatively few limits on what trades can occur other than those set out by the person creating the market. For example, there might be restrictions on what type of currency can be exchanged. Other limitations might include limiting trades to specific countries or excluding certain types of assets from trading altogether. It’s easy to see why cryptocurrency has become so popular when considering all this information!

How Do You Earn Bitcoins?

Bitcoin mining is how new bitcoins are brought into circulation. Miners are rewarded with cryptocurrency for verifying and committing transactions to the blockchain. Mining is a computationally intensive process that requires powerful hardware. Bitcoin miners can earn cryptocurrency without having to put down money for it. Unlike with other investments, there’s no need to rely on the stock market or on people you know in order to make your own currency work for you. With a small investment in equipment, anyone can get started as a miner and potentially live off bitcoin mining as an income. One way to purchase a piece of mining equipment is through cryptocurrencies like Dash (DASH). If you want to buy more than one mining machine, this may be an option. You will have to find a seller who is willing to sell them in batches. You can also look into converting these machines from another form of cryptocurrency, such as Ethereum (ETH) or Monero (XMR), which has cheaper hardware prices than Bitcoin. However, both DASH and ETH still have higher costs associated with their mining operations than Bitcoin does. Monero offers lower costs but doesn’t come with the same benefits when it comes to security and ease-of-use when compared to DASH.

The first question you’ll need to ask yourself before getting started is what kind of hardware do I want? A GPU? An ASIC? Which would best suit my needs? What would happen if I tried to mine with my current computer? How much electricity do they use per day? These are all questions you should consider before purchasing any type of equipment. While GPUs and ASICs are usually used by individual miners, large mining companies generally invest in GPUs. ASIC chips cannot currently be used by individual miners because they consume too much power.

If you’re looking for something smaller and easier to maintain, then GPUs might be the better choice. There’s less power consumption with GPUs, so there’s less risk of damage to your electrical system during a power outage. They’re also faster than other types of hardware since each processor chip can calculate many different pieces of data at once.

Where Can I Spend Bitcoins?

You can use Bitcoin to purchase goods and services online at merchants that accept cryptocurrency. You can also use Bitcoin to buy gift cards for popular retailers, including Amazon, Starbucks, and iTunes. Some people even use Bitcoin to buy gold and silver. There are now many major companies accepting Bitcoin as a form of payment, from Dell to Expedia. With the recent decline in its value, more merchants have begun accepting it as a form of payment for their products and services. In 2017, there were around 100 000 Bitcoin transactions per day. As of September 2018, that number has dropped down to about 60 000 per day. The main reason for this drop is due to an increase in Bitcoin transaction fees. They went up from $0.5 USD back in early 2017, to over $3 USD per transaction today! And the network is getting clogged with more transactions because Bitcoin was never designed to be used this way (see What’s Happening with Bitcoin? below). One solution is that you can pay extra money for your transaction fee and make sure it gets processed within 24 hours. But these days, if you want your transaction to go through quickly and cheaply, Bitcoin Cash or Litecoin are both better options than Bitcoin. But don’t worry there’s still plenty of time before cryptocurrencies lose their appeal entirely. Cryptocurrencies will continue evolving and changing as they grow and eventually they’ll change so much that they’re not even recognizable anymore!

What Should I Know Before Investing In A Cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. A currency is a type of money or other medium of exchange that is either present in physical form (such as coins and paper money) or digitally represented (such as a balance on a bank account). It is usually designated by a unit of account which represents wealth but does not have any intrinsic value. The world’s traditional currencies currently consist primarily of physical paper bills and coins; however, there is an increasing trend towards digitization with mobile banking through smartphones now being the fastest growing method for managing finances. A central bank typically regulates a country’s monetary policy by setting interest rates and controlling the amount of credit that banks offer. Central banks were originally instituted because one of the purposes was to regulate the amount of inflation in a nation’s economy ensuring prices increase at about the same rate, rather than too quickly or too slowly.

Understanding The Blockchain Technology

The blockchain is a distributed database that allows for secure, transparent and tamper-proof transactions. This makes it perfect for use in the cryptocurrency space. The blockchain is a decentralized ledger that records all transactions chronologically and publicly. This means that anyone can view the transaction history of any given asset, providing transparency and trust. The blockchain is also immutable, meaning that once a transaction is recorded, it cannot be altered or deleted. This makes it incredibly secure, as there is no single point of failure. With traditional data storage, one system being compromised could spell doom for the entire network. With this technology, even if you were able to access a node on the network and alter its data, the other nodes would still have record of those changes. It’s a peer-to-peer network, so every computer connected to the blockchain has an identical copy of all the data stored on it. In addition, because each block contains information about where it came from and where it was sent to (using hashes), tampering with one block in the chain will render all subsequent blocks invalid as well. That’s why people say that the blockchain is tamper-proof. It goes beyond security, though. Blockchain technology provides more than just digital signatures; these are some of the ways it impacts our lives:

Streamlining International Payments Have you ever had trouble sending money overseas? You might not need to anymore thanks to Bitcoin and companies like BitPesa who offer fast international payments without hefty bank fees or long wait times. For example, when you send money internationally through traditional banks, they often charge around $50 per wire transfer and up to 2% in currency conversion fees. Compare that to what BitPesa charges $3-$5 per transaction plus 3% exchange fee and it’s easy to see which company is offering better value.

5 Things You Need To Know Before Investing In An Initial Coin Offering (ICO)

Before investing in an ICO, do your homework and make sure you understand what you’re getting into. Here are five things you should know before investing in an ICO .

- What is a utility token?

- What is a security token?

- How much money can I expect to make from an ICO?

- What does it mean if the company has a lock-up period for their tokens?

- How can I check whether or not an ICO is legitimate?

Why Is The Blockchain So Secure?

The blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as completed blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the block chain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere. (This can be done by examining the link between successive blocks.) Full nodes also check if bitcoins were appropriately spent according to rules specified in the Bitcoin protocol. (For example, some transactions may only be spendable if they’re less than a specific amount.) If everything checks out, miners add the transaction to their copy of this ledger. Once recorded, an entry cannot be altered or removed; hence why we call it immutable. Once a block has been verified, it’s given a unique signature by the miner. That signature serves as proof of work for that miner no one else needs to do the work again unless there’s a disagreement on which transactions are valid. Transactions on bitcoin’s public ledger can’t be undone without altering all subsequent blocks. In order for someone to alter any historical record on the blockchain, they would need more computing power than everyone else combined.

5 Things You Need To Know About Bitcoin Forks And Airdrops

1. A fork is a change to the protocol of a cryptocurrency that creates two separate versions of the blockchain.

2. Airdrops are when a cryptocurrency project distributes free tokens or coins to its community.

3. Forks and airdrops can be used to create new cryptocurrencies.

4. Bitcoin forks have been used to create Bitcoin Cash, Bitcoin Gold, and other altcoins.

5. Airdrops have been used to create many new ERC20 tokens on the Ethereum blockchain.

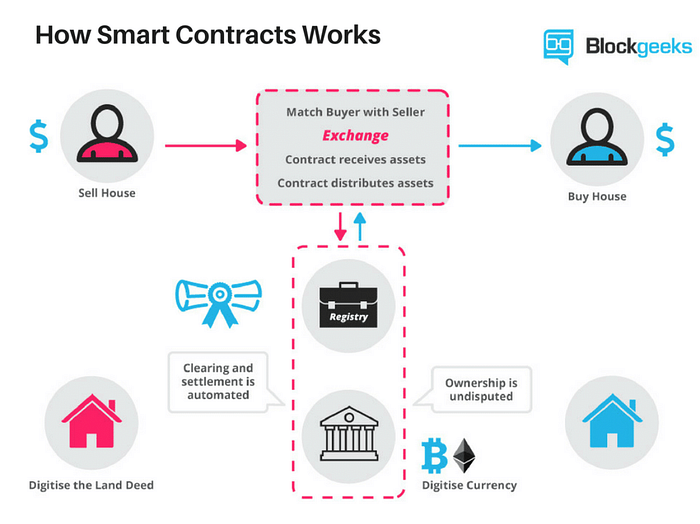

What Are Smart Contracts And DApps?

A smart contract is a computer protocol that facilitates, verifies, or enforces the negotiation or performance of a contract. Smart contracts allow the performance of credible transactions without third parties. For example, an escrow can be created in code with three people: a buyer, seller and an arbiter. The arbiter’s job is to come up with unbiased solutions for any disagreements between the other two parties and then execute these decisions on the blockchain for all participants to see. All parties are able to agree on the decision because they have a copy of the transaction which cannot be altered.

In short, there are four main types of blockchains: public blockchains, private blockchains, consortium blockchains and hybrid blockchains. Public blockchains are open-source projects which anyone can participate in. Bitcoin is a good example of this type of blockchain project. Private blockchains are closed-source and controlled by a single entity. Consortium blockchains are semi-public networks where permissioned members must approve transactions before they go through. Hybrid blockchain networks combine aspects of both public and private chains. They often have some centralized control over what data goes into the ledger but still provide decentralized control over who can validate transactions.

— — -FULL COURSE LINK — — -

No comments:

Post a Comment